vermont income tax rate 2020

Check the 2020 Vermont state tax rate and the rules to calculate state income tax. Pay Estimated Income Tax by Voucher.

Income Tax Rate On Private Limited Company Fy 2021 22 Ay 2022 23

2019 Vermont State Tax Tables.

. PA-1 Special Power of Attorney. No change in the supplemental rate for 2020 per the Department regulation. The state supplemental income tax withholding rates that have thus far been released for 2020 are shown in the chart below.

PA-1 Special Power of Attorney. Corporate and Business Income. 2020 VT Rate Schedules.

IN-111 Vermont Income Tax Return. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017Vermonts tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020.

Tax professionals who register by June 15 at 5 pm. There are a total of eleven states with higher marginal corporate income tax rates then Vermont. A 2020 Income and Expense analysis and a fully completed Commercial.

Find your pretax deductions including 401K flexible account contributions. Tax Tables 2020 2020 Vermont Tax Tables. Vermont State Personal Income Tax Rates and Thresholds in 2022.

Residents of Vermont are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021. Meanwhile total state and local sales taxes range from 6 to 7. PR-141 HI-144 2020 Instructions 2020 Renter Rebate Claim.

Vermont School District Codes. Pay Estimated Income Tax Online. 2021 Tax Rates Just Released.

Find your gross income. Ad Compare Your 2022 Tax Bracket vs. By the tax rate set annually by the Loudoun County Board of Supervisors.

Vermont has one of the highest average property tax rates in the. IN-111 Vermont Income Tax Return. RateSched-2020pdf 11722 KB File Format.

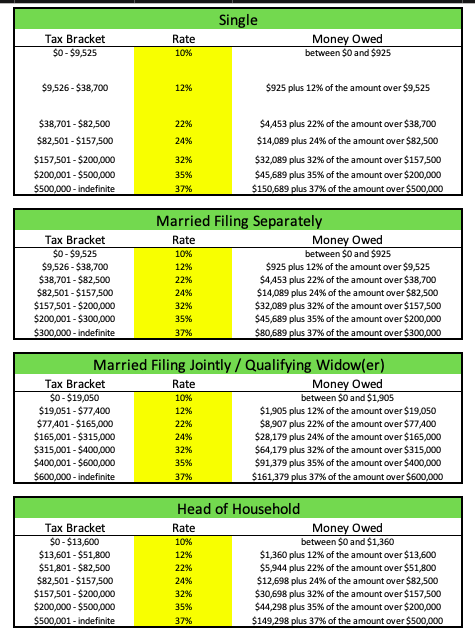

The Vermont Married Filing Jointly filing status tax brackets are shown in the table below. Pay Estimated Income Tax by Voucher. How to Calculate 2022 Vermont State Income Tax by Using State Income Tax Table.

7500 25 Of the amount over 50000. 2021 Income Tax Withholding Instructions Tables and Charts. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017.

Details of the personal income tax rates used in the 2022 Vermont State Calculator are published below the calculator. Tax amount varies by county. PA-1 Special Power of Attorney.

IN-111 Vermont Income Tax Return. 2020 VT Tax Tables. 2020 VT Tax Tables.

Volunteer Income Tax. Vermont School District Codes. The standard rate starting June 16 will be 289.

575 plus local tax rate. Payroll 2020 in Excel Vermont State Withholding Rates. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

Appealing Your Commercial Real Estate Tax Assessment 2020 Page 1 of 5. W-4VT Employees Withholding Allowance Certificate. 2020 Vermont State Tax Tables.

Personal Income Tax - 2019 VT Rate Schedules. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. 2020 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

2020 Vermont Tax Deduction Amounts. 2020 Vermont Education Tax Rates Information Videos. 2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Find your income exemptions. The median property tax in Vermont is 344400 per year for a home worth the median value of 21630000. The statewide sales tax rate in Vermont is 6 which is relatively low compared to other states.

On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes. Marginal Corporate Income Tax Rate. ET qualify for an Early Bird rate of 240 per person.

Find your income exemptions. 20 with live-streamed webinars broadcast on Tuesdays Wednesdays and Thursdays. There are -779 days left until Tax Day on April 16th 2020.

TaxTables-2020pdf 27684 KB File Format. Vermont Income Tax Rate 2020 - 2021. Discover Helpful Information and Resources on Taxes From AARP.

Vermont has a progressive income tax with rates ranging from 355 to 875. Vermont Income Tax Return. Counties in Vermont collect an average of 159 of a propertys assesed fair market value as property tax per year.

Individuals Personal Income Tax. Changes from 2019 are highlighted in yellow. LC-142 2020 Instructions 2020 File your Landlord Certificate Form LC-142 online using myVTax or review the online filing instructions.

Your 2021 Tax Bracket to See Whats Been Adjusted. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax. W-4VT Employees Withholding Allowance Certificate.

Find your gross income. Pay Estimated Income Tax Online. A few cities collect an additional local tax of 1.

For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. The Vermont tax rate is unchanged from last year however the income tax brackets. PA-1 Special Power of Attorney.

2019 VT Tax Tables. The Vermont Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Vermont State Income Tax Rates and Thresholds in 2022. Check the 2022 Vermont state tax rate and the rules to calculate state income tax.

How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table. Pay Estimated Income Tax by Voucher. CPA EXPLAINS 2021.

Income tax slab 2020-21 Pakistan Tax Rates for. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets.

Tax Year 2020 Personal Income Tax - VT Rate Schedules. Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like gasoline and cigarettes. Tax Rates and Charts Mon 01112021 - 1200.

Find your pretax deductions including 401K flexible account contributions. 159 of home value. 2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Provided the state does not have any outstanding Title XII loans payment of state unemployment taxes in a timely manner reduces the federal unemployment tax rate from 60 to 6 so it is important to pay your state unemployment. 2019 VT Rate Schedules.

W-4VT Employees Withholding Allowance Certificate. 2021 Vermont State Tax Tables. Budget 2020 New Income Tax Rates New Income tax.

The 2020 Nationwide Tax Forums will begin on July 21 and continue through Aug. 80 for Maryland nonresidents and 32 for residents employed in Delaware. W-4VT Employees Withholding Allowance Certificate.

Vermont State Personal Income Tax Rates and Thresholds in 2022.

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Small Towns Usa

State Income Tax Rates Highest Lowest 2021 Changes

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Property Taxes By State In 2022 A Complete Rundown

How Is Tax Liability Calculated Common Tax Questions Answered

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

States With Highest And Lowest Sales Tax Rates

How Is Tax Liability Calculated Common Tax Questions Answered

Star Studded Line Up On Judging Panel Announced For Wirex And The Fintech Times Rising Women In Cr Fintech Forex Trading Tips Cryptocurrency Trading

The States With The Highest Capital Gains Tax Rates The Motley Fool

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

Per Capita Sales In Border Counties In Sales Tax Free New Hampshire Have Tripled Since The Late 1950s While Per Capita Sales In Big Sale Clothing Store Design